- The company ranked first place in Colombia, within the “Empresa Líder en Sustentabilidad” category of the ALAS20 Initiative.

- The recognition is based on SURA Asset Management´s practices regarding risks associated with ESG factors.

Medellín, February 2nd, 2024. SURA Asset Management, Leading company in savings, Investments, and asset management, ranks first in Colombia within the “Empresa Líder en Sustentabilidad” Category, ranking done by the initiative Agendas Líderes Sustentables, ALAS 2023. The Company was recognized for its excellence in the public disclosure of Environmental, Social and Corporate Governance (ESG) information.

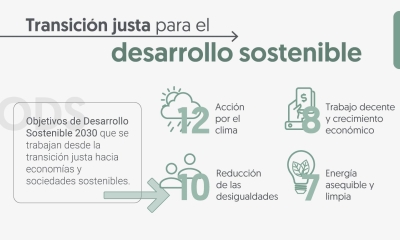

ALAS20, organized by GovernArt and recognized as the only Hispanic American initiative that evaluates, rates, and recognizes excellence in the public divulgence of information surrounding practices of sustainable development, corporate governance, and responsible investments, has distinguished the organization for its outstanding commitment with sustainability. For the technical evaluation of this category, carried out by Morningstar Sustainalytics, the ESG Risk Rating Methodology was used, which measures the enterprise value risk based on ESG factors.

In this regard, Ignacio Calle, CEO de SURA Asset Management, expressed the following: “This recognition reflects our firm compromise with sustainability. At SURA Asset Management we are convinced that sustainability is an opportunity to generate long term value for our clients and society as a whole.”

At SURA Asset Management, sustainability is part of the corporate strategy and is understood as an active commitment to generate trust in its stakeholders, seeking lasting relationships that strengthen its competitive capacity and promote long-term growth. This considers economic, environmental, social, and corporate governance aspects in all its operations, in line with its fiduciary duty to seek the best profitability for its clients, always under the standards of excellence and good industry practices.

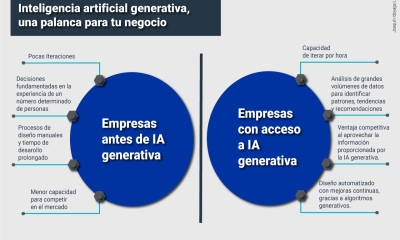

In the corporate and portfolio management, the company incorporated the ESG criteria. Thus, sustainability is not only an objective but a guide for all of the company’s actions and decisions, reflecting its commitment with the creation of shared value and sustainable development, in the countries where it operates, which is evident in the brands reputation percentage in the social and environmental performance dimension, that showed an 82.5% according to an own study carried out in 2022.

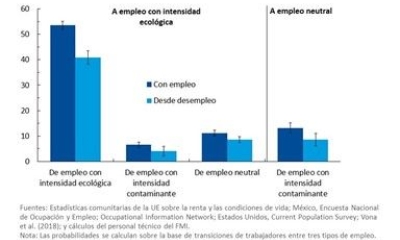

This acknowledgment is also supported by the initiatives and strategies carried out by SURA Asset Management. Among said actions, the following stand out: being signatories of the Principles of Responsible Investment (PRI), through five of its pension fund administrators and SURA Investments; the adhesion of SURA Asset Management to the Climate Initiative of investors in Latin America, within the framework of COP26, and the percentage of assets under management -AUM- that to date have a carbon footprint measurement and which amounts to 31.8%.

SURA Asset Management, in its handling, reaffirms the commitment through sustainable investment; from avoiding negative impacts to actively promoting positive practices, for which it analyzes controversial sectors and companies, integrates ESG criteria in its financial analysis, and actively promotes positives practices in its value chain, in line with its approach of contributing towards the construction of a more sustainable future.

SURA Asset Management, en su gestión, reafirma el compromiso a través de la inversión sostenible; desde evitar impactos negativos hasta promover activamente prácticas positivas, para lo que analiza sectores y compañías controversiales, integra criterios ESG en su análisis financiero, y promueve activamente prácticas positivas en su cadena de valor, en línea con su enfoque de aportar a la construcción de un futuro más sostenible.

About Sura Asset Management

SURA Asset Management is an expert Company in savings towards retirement, investments and asset management with presence Chile, Mexico, Colombia, Peru, El Salvador, Uruguay, United States of America, and Luxemburg. Is a subsidiary of Grupo SURA, with other minority shareholding shareholders. As of September 2023, SURA Asset Management has 158.7 million USD in assets under management belonging to more than 23 million in the region.